All Categories

Featured

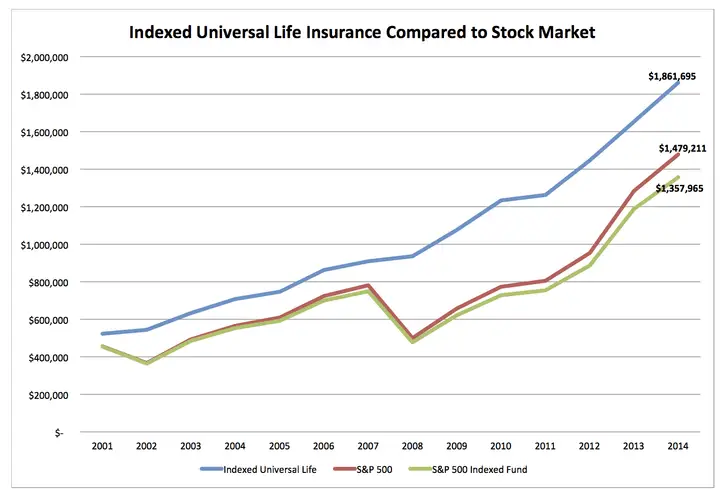

If you're going to utilize a small-cap index like the Russell 2000, you may want to stop briefly and take into consideration why a good index fund business, like Vanguard, does not have any type of funds that follow it. The factor is due to the fact that it's a poor index. Not to discuss that transforming your whole plan from one index to one more is rarely what I would call "rebalancing - mortality charge for universal life policies." Money value life insurance coverage isn't an attractive asset class.

I have not even addressed the straw man right here yet, and that is the fact that it is reasonably unusual that you in fact need to pay either taxes or significant payments to rebalance anyhow. I never ever have. The majority of intelligent capitalists rebalance as long as possible in their tax-protected accounts. If that isn't quite sufficient, early collectors can rebalance purely using new contributions.

Iul Life Insurance Pros And Cons

Decumulators can do it by withdrawing from possession courses that have succeeded. And obviously, no one should be purchasing loaded common funds, ever before. Well, I really hope messages like these help you to translucent the sales tactics often utilized by "economic professionals." It's really as well poor that IULs do not work.

Latest Posts

Index Universal Life Insurance Companies

Best Equity Indexed Universal Life Insurance

Death Benefit Options Universal Life